Why reesfi

At reesfi, we partner with non-bank money lending institutions and service providers, to design, develop and deliver customized lending solutions that meet the needs of their customers—whether they have an existing credit history.

We achieve this by utilizing alternative data to fuel our advanced, proprietary scoring engine. Its machine learning-driven framework consistently evolves and adapts to the changing behaviors of our customers, ensuring swift and precise profiling throughout every phase of the product lifecycle. This version maintains the original meaning while using different phrasing.

This strategy has laid the groundwork for our success, but we continue to push forward.

Why work with ReesFi

Rees’ 100% digital solution empowers consumers to proactively manage how they shop and for merchants and financial institutions to effectively engage with targeted consumers

Consumers

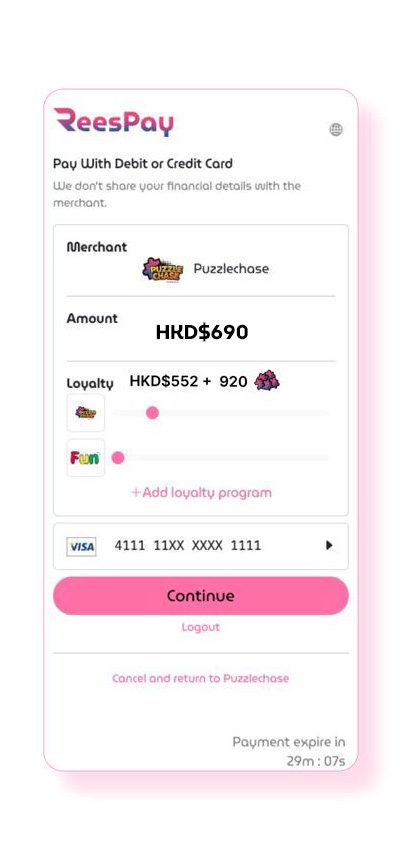

- Customer checks out with reespay by selecting pay now or pay later option

- Payment can be combined with participating loyalty points

- Pay later customer get matched to lenders that fit its profile

Non Bank Financial Institutions (FIs)/Lenders

- Lenders are matched with customers that fits its lending criteria and profile

- AI decisioning algorithm to offer personalized product

Merchants

- Promote sales conversion as credit and repayment via rewards is accessible to consumer

- Payment solution easily integrated to merchant’s store to avoid cart abandonment